Outstanding Info About How To Check A Charity Number

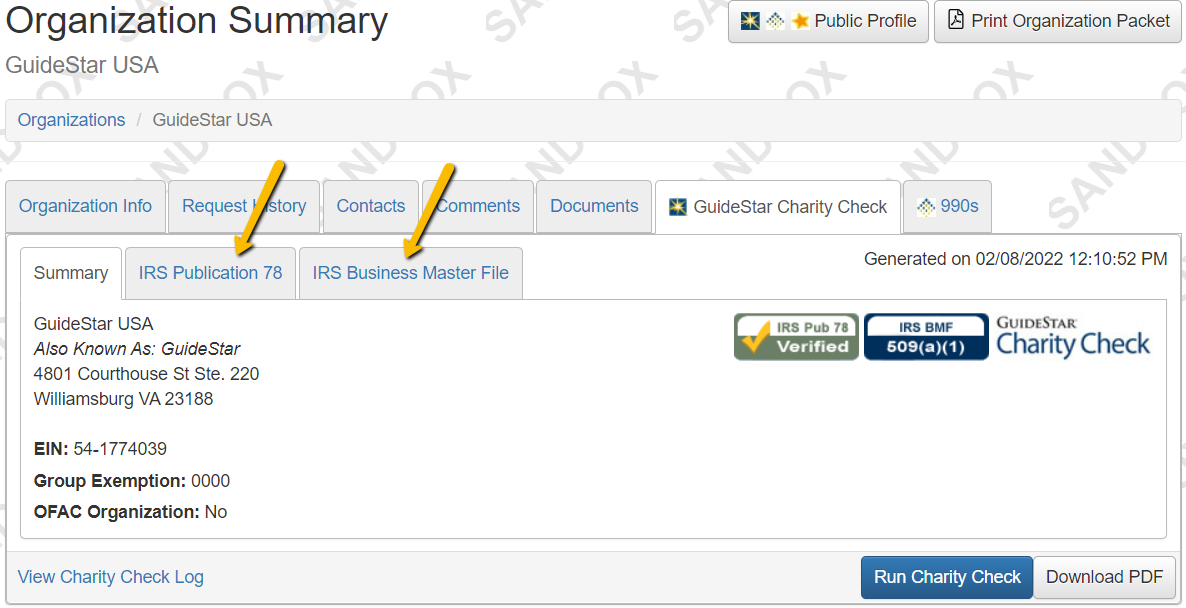

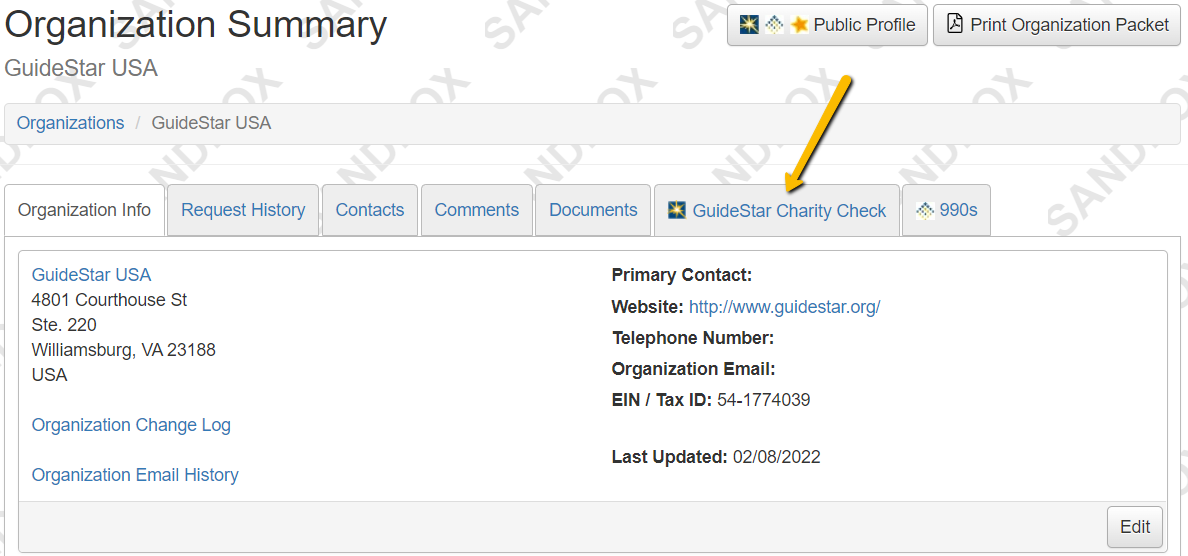

Guidestar is the most complete source of information about u.s.

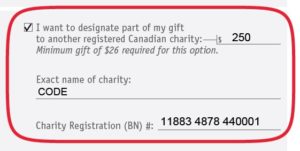

How to check a charity number. Tell us whether you accept cookies. 5 tips for avoiding charity frauds & scams. Enter the organization name, state charity registration number, fein, secretary of state or franchise tax board number of the organization you are looking for and then click on the.

A search tool for donors and charities used to find registered or revoked charities and their annual information returns, which include finances and activities. A charity must have 501 (c)3 status if you plan to deduct your donation on your federal taxes. You can also view charities by:

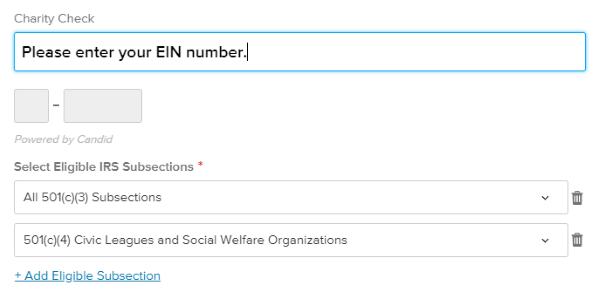

The public register of charities contains information about more than 11,400 charities that have been registered with the charities regulator. To verify a nonprofit’s 501c3 status, go to the irs select check website and search their name or employer identification number. In the united states, this status is called 501 (c) (3) after the relevant part of the internal revenue code.

You can also find out how much the charity is spending on administration. Enter one to three words you are sure of. A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making.

Enter charity name, charity number or search for words in charity objects, activities or classifications. You can also check the irs’s revocation database to make. Check a charity's 501 (c)3 status with the irs' exempt organization database.

Leave out the and and and &. Also, check out the irs page on. Directory of charities and nonprofit organizations.

/do0bihdskp9dy.cloudfront.net/09-08-2022/t_037f8d5572f04221af53f341e3a991c1_name_file_1280x720_2000_v3_1_.jpg)